Don’t worry.

That’s not my door you see getting smashed in the lead photo. It’s from an accident I passed on my way to a meeting last Wednesday morning.

But one day earlier, I paid more than $1,300 for my latest vehicle repairs. My damage was basic wear and tear. I couldn’t imagine coming out of pocket for a door after a freak accident.

Who’s responsible for such an accident anyway?

The truck driver who smashed into the door? The owner of the smashed vehicle? Or the poor soul sitting in the backseat who flung open the door and probably saw their life flash before their eyes?

I’ve always been overly cautious when opening doors to exit vehicles while parked along busy streets. Wednesday showed me the type of collision I’ve always been afraid of, whether stepping out of my personal vehicle, a friend’s or an Uber.

I’m glad my car trouble was much less mentally taxing than the wreckage I witnessed Wednesday. I wouldn’t trade places with either driver or the backseat passenger — even if my bill cost more than their new door.

I just needed new struts.

Rattling and knocking sounds that I hadn’t noticed when I bought my car in September had grown severe. Drive time became uncomfortably noisy. Ragged roads weren’t required to hear my ride’s cries. She shouted both when I hit certain speeds and also when I applied the brakes.

A trusted mechanic advised me that I also should replace my engine and motor mounts. He even popped the hood and had an employee rev my engine to show me how my engine was moving. Then he pointed out exactly where one mount is tearing.

That job is next. It will cost another $1,179.66, including an 8% discount the shop owner granted.

But I had to handle the struts.

We’re piling into the car and hitting the road this week. It’s again time for our annual trip to Oklahoma, the state in which Parker was born and I grew up. It’s a 762 mile trek, one way. It’s always a good time to make sure my vehicle is in good condition.

Long time readers of Money Talks know that car trouble is my biggest bugaboo. It’s the reason I became obsessed with learning to be smart with money. And this is my second bout with vehicle repairs already this year.

It’s not how anyone envisions their first nine months driving a new car.

But once again, I was prepared for the blow.

Because I was armed financially thanks to having a fully funded (and compounding) freedom fund, I also survived the mental hit quite easily.

It was another testament to being a good steward of my money.

I never even had to dip into my freedom fund.

Instead of disturbing the compound effect, I took the money from my brokerage. I sold several stocks in April and May, which armed me with a wad of cash.

My plan was to redirect the money into my Roth IRA. The idea was to consolidate, trust index funds over individual stocks and move my money to a tax-advantaged account.

But then life happened.

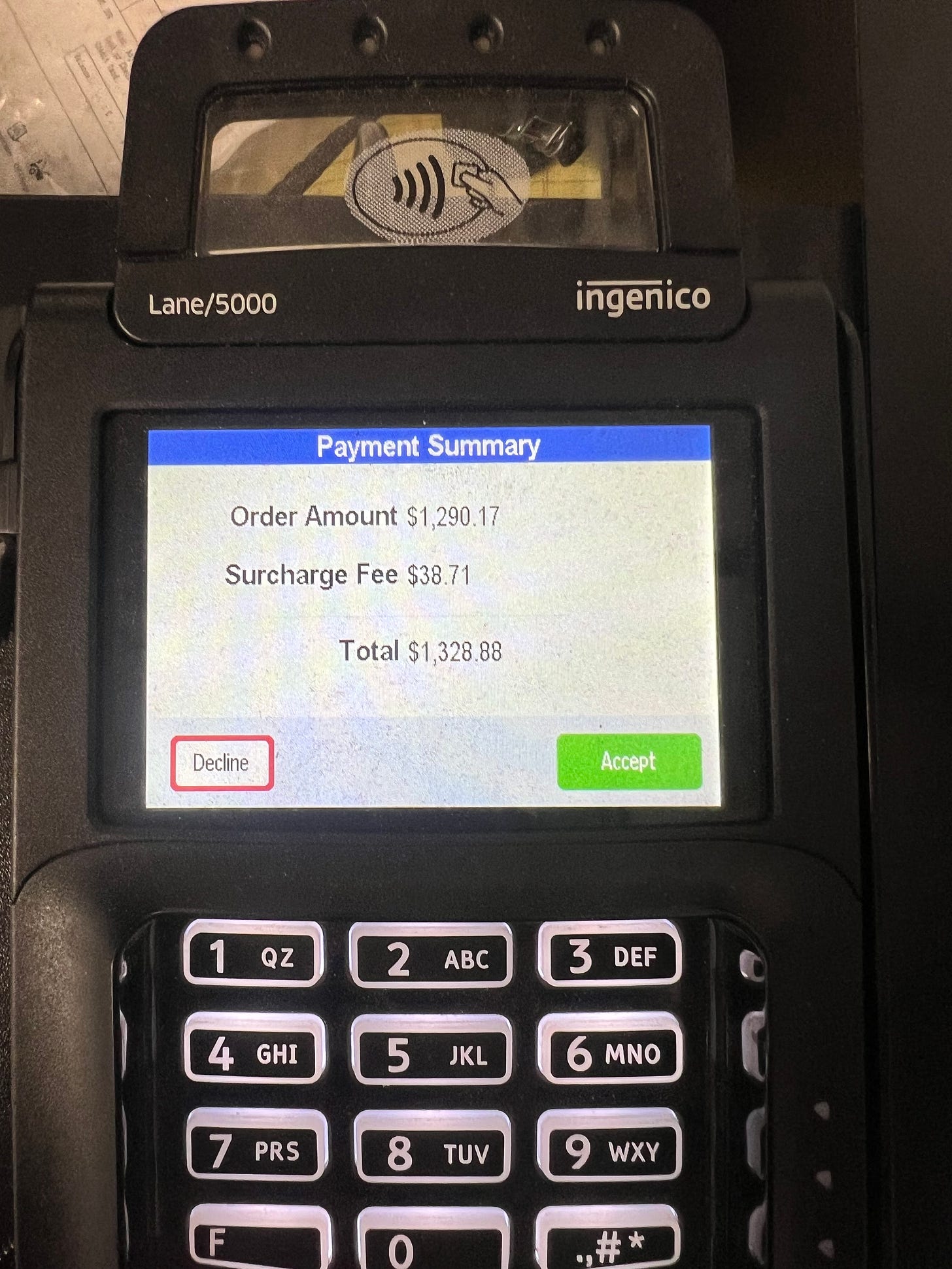

An attorney bill raised my spending in May. My vehicle repairs have already skyrocketed my bill in June. My $1,328.88 final tally included a 3.5% surcharge for paying with my credit card. Convenience cost me $38.71. But I’m a sucker for my loyalty points.

The cost of my car repairs on June 4 exceed my total spending in June 2023.

I can laugh about things like that now.

I’m living life a lot differently now that I’m prepared for its blows.

Learn to be thankful

It’s easy for me to be thankful. I learned that lesson early in life. It’s one I picked up in middle school, while living in West Africa for what proved to be a critically important two-year chapter in my life. My mother worked as a U.S. diplomat in my adolescence. Her first tour stationed us in Dakar, Senegal when I was in…

My $25,000 mistake

The letter, from The Oklahoman Media Company, is dated March 26, 2018. It still sits on the floor under my nightstand, right on top of my Bible. For nearly five years, I foolishly watched both collect dust. I wish I had that time back. I’d pick up the Good Book more, and I’d get a mulligan on one of the worst money mov…

Three next level money moves

I told you last week that T-shirts were my best money move of June. But I recently made three other money moves that carried just as much weight. Let’s start with the biggest and, in my book, the smartest. On June 15, I made a $2,077.85 transfer from one of my brokerage accounts to my emergency fund. I didn’t have to se…