It took me two years, but I’ve finally rewarded my daughter, Parker, with her first pay raise.

She truly deserves every penny.

But her bump comes with a caveat.

At the start of February, we sat and discussed the details. Because it’s a big change — a complete shift from how Parker has been compensated and accustomed to investing for nearly 2 1/2 years.

Here’s our new plan to grow Parker’s wealth.

For her role as a partner at Money Talks, Parker will be paid $583.33 per month.

Why such a specific number?

Until now, there was no set number. I just funneled as much money as I could to Parker’s IRA. Including catch-up contributions for 2023, we invested $8,100 into her retirement account.

Not a bad start. Nor was it a plan.

A $583.33 monthly payment equates to $6,999.96 a year— just four cents less than the $7,000 maximum allowable contribution for IRAs in 2025.

We project that Parker’s account will be worth more than $3 million by the time she’s 60 simply by maxing out her Roth each year.

The drawback for Parker is another 38 years of delayed gratification.

It’s the second time that I’ve significantly deferred Parker’s riches.

When I started investing Parker’s money into the stock market in October 2022, my plan was to give her the funds as a high school graduation gift. After opening Parker’s custodial account in April 2023, however, I learned that state law mandates the account be transferred at the age of 21.

Now, I’m redirecting money from Parker’s custodial account to her Roth — this kid is going to be the most patient investor of all time!

Hopefully this strategy helps her become a savvy investor, too.

Since December 2022, Parker has dollar-cost averaged $336 per month into the Vanguard High Dividend Yield Index Fund ETF, ticker symbol VYM. Not long ago, I anticipated this vehicle becoming Parker’s greatest asset.

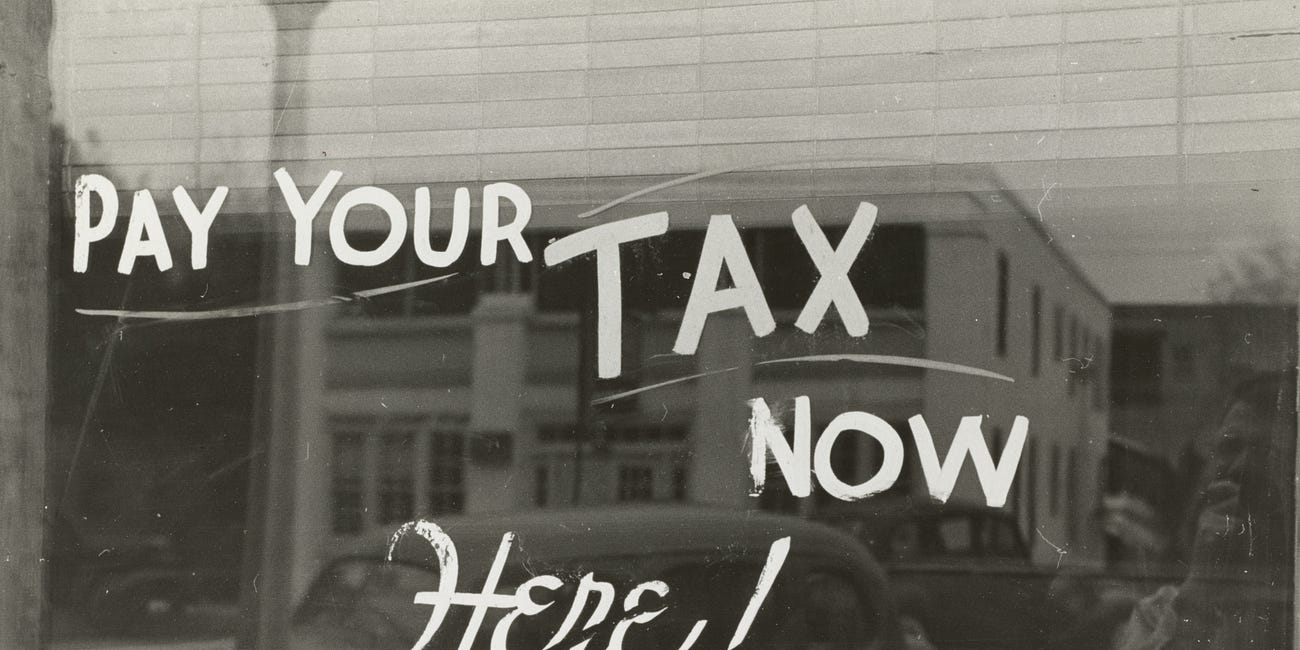

However, her custodial account is a taxable account. And like I’ve always told you, Parker, your Uncle Sam is not someone you want to play with. He’s always lurking, like that annoying mean girl you can’t stand.

You can’t evade him.

But you can avoid him.

By maxing out Parker’s tax-advantaged Roth IRA, she’ll take advantage of nearly $2 million in tax savings when she’s 60. Withdrawals at that point will be tax-free.

By comparison, anytime Parker sells the VYM for profit, she will trigger a taxable event — which means she’ll pay additional taxes on gains that were created with after-tax money.

Since early last year, I knew my investments weren’t structured properly. I reduced my stock purchases in my taxable account last year as a result. It made more sense for me financially to prepare to buy real estate and focus on investing as much money as possible into my tax-advantage accounts like my 401(k), Roth IRA and HSA.

This change to Parker’s compensation plan ensures that she’ll also begin to maximize every dollar — because if we’re going to play the game, we might as well play it smartly.

To meet her new compensation, I must reduce Parker’s monthly contribution to the VYM from $336.

She’ll now receive $167 per month from me in addition to her compensation. That figure equates to just over $2,000 per year. I’ll work to increase my contribution, but by maintaining her monthly investment, we’re ensuring Parker has an appreciating asset that will be worth at least five figures when she’s 21.

For now, we’ll continue to invest 100% of Parker’s Money Talks compensation into the Vanguard Total World Stock Index Fund ETF, ticker symbol VT.

Recently, I’ve considered adding a few growth stocks to maximize Parker’s returns within her IRA. Since opening her position in the VT in March 2024, Parker’s stake is up only 9.4%.

The S&P 500 returned 25% in 2024 and 26.3% in 2023.

We’ve been sacrificing greater gains for more safety.

I’m cautious of straying too far from the simple path for wealth, but I’ve learned more, and I know we can achieve better performance.

Bitcoin is another asset I’m considering for Parker’s investment portfolio. Bitcoin saw a 114% return in 2024, and shrewd investors project the digital currency to rocket higher in 2025 and beyond. Parker is well-positioned to participate in any potential rise, and I’d be remiss if I ignored the wealth transfer happening right in front of me.

I can’t afford to resist change or fail to position my family at the forefront.

Parker’s new compensation plan is a testament to my commitment to evolving as I gain more financial education. The knowledge I’ve acquired has empowered me to make confident choices.

It should be a reminder that your first step doesn’t need to be perfect, and your early decisions don’t have to last forever.

Start where you are. Do what you can. You can always adjust as you go.

Parker's first job opens a simple path to wealth

I signed our first contract for Money Talks just before 4:30 p.m. on a Friday. To celebrate, I researched Roth IRA’s for Parker.

Talking taxes with Parker

On the final night of February, a leap year this year, I had my first real money talk with Parker about taxes.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.

“It should be a reminder that your first step doesn’t need to be perfect, and your early decisions don’t have to last forever.”

What a wonderful thought to bring ease and comfort when someone is learning to adjust in life and or financially.