The financial blow I’d been bracing for landed hard on the third day of February, a brutal left hook I couldn’t dodge.

“You’ve been hit before,” I reminded myself, trying to shake off the shock.

Legal fees were throwing haymakers, intent on knocking me out. I knew I had to step up my game if I wanted to stay in this fight. With each new bill, I visualized myself bobbing and weaving, refusing to let this despicable debt win.

“Keep your guard up,” I urged, focusing on the path ahead. “Don’t quit.”

It wasn’t just about surviving this round; it was about rising stronger, with an unwavering determination to reclaim my financial footing.

As February unfolded, it felt like Round 2 of my battle with my budget, demanding extended cutbacks. Each decision to tighten my belt was a strategic move in the ring, where every dollar counted.

I scrutinized every expense, prioritizing needs over wants. I pushed myself to stick to the plan, sacrificing temporary pleasures like mouth-watering pizza and an occasional ice cold beer.

Hopefully, things will settle after March, but my first two months of the year were a heavyweight fight for financial stability.

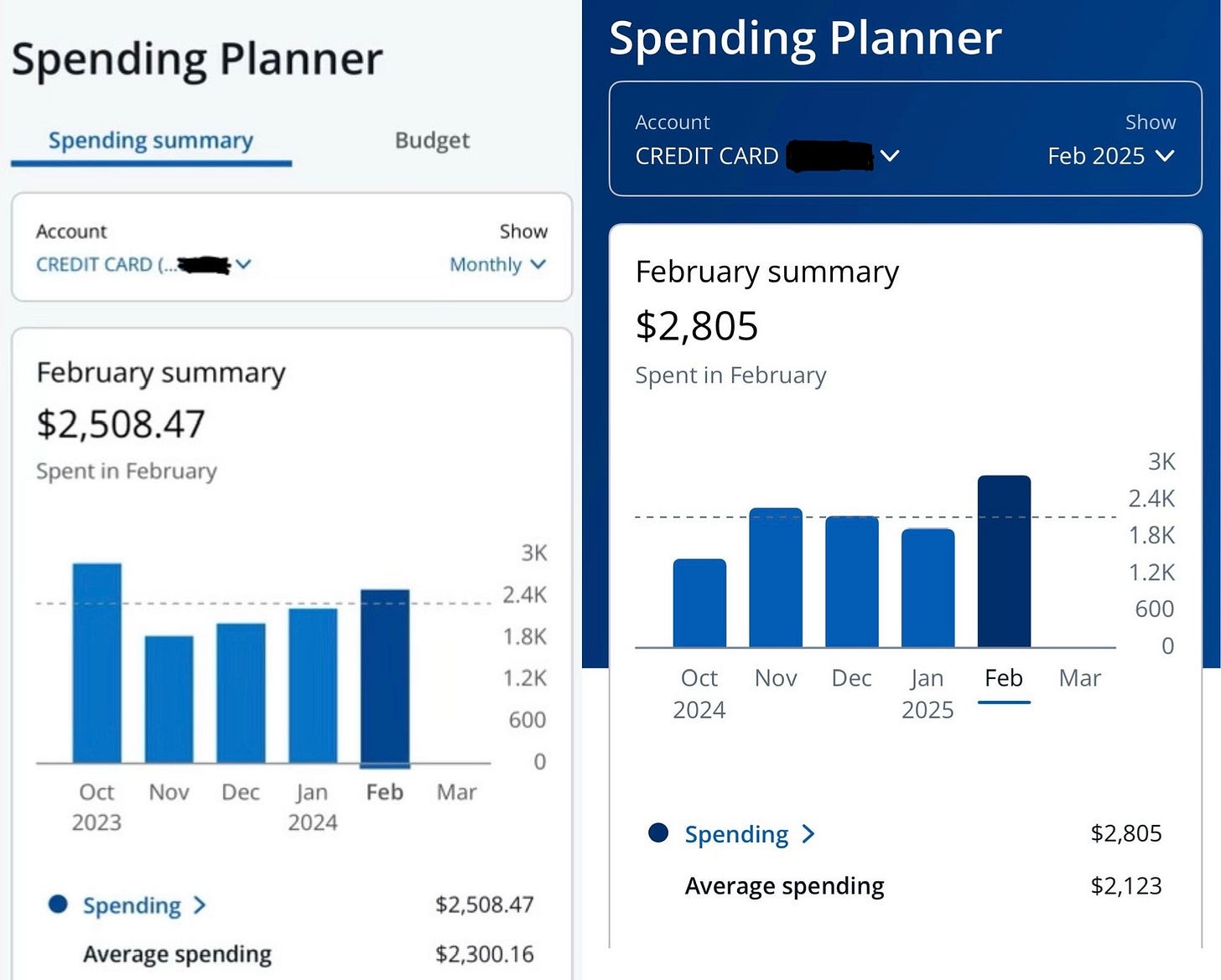

I make the majority of my purchases with a credit card so I can accrue airline points to fly for free. While a few essentials — like rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership — are excluded, tracking my expenses through my credit card helps me monitor my spending effectively. Each month, I share my progress, for better or worse.

As expected, February saw a spike in my spending as I grappled with the costly legal fees from ongoing disputes with my co-parent.

After consuming nearly half of my budget in January, legal fees accounted for 54% of my February spending.

My legal expenses totaled $1,528 in February. When I add the $864.50 I paid for attorney costs in January, I’ve already spent $2,400 on litigation this year.

But I’ll never stop fighting for my daughter Parker — no matter the cost.

Yet when half of your spending in the first two months drains away into what feels like a never-ending money pit, the mind games begin. You start to feel like a fool, as if all the hard work you’ve ever put in amounts to nothing. The frustration gnaws at you, making it hard to see the light at the end of the tunnel.

One fateful day in court has threatened to torpedo more than two years of top-notch stewardship with my money.

I’ve had to rework Parker’s longstanding stipend to absorb my rising expenses. Along with the mental and emotional toll this battle takes, there’s the cruel financial hit. Each dollar I spend on bills is a dollar that isn’t going toward Parker’s future. It feels like being rocked by a three-piece combination, leaving me reeling.

My aim is to limit my credit card spending to $25,000 this year, which means I need to spend less than $2,083.33 per month. Unfortunately, my legal fees alone accounted for almost three-quarters of that monthly budget, making it nearly impossible to stay on track.

That didn’t stop me from trying, trusting that my discipline would eventually lead me to victory.

I can count on one hand how many times I’ve dined out or purchased alcohol this year — just three meals and two liquor runs. I’ve cut back on smoking, streamlined my grocery shopping and kept things low-key.

In the midst of these sacrifices, what hasn’t changed is my commitment to creating lasting memories.

I paid $145 for my long-awaited date night with Parker. That included our Daddy-daughter dance registration, a fresh new outfit for Parker, an all-you-can-eat sushi dinner for two and an adorable heart-shaped snow globe photo of us.

On Feb. 26, I booked a Daddy-daughter trip of a lifetime. We can’t wait to share all the details soon. Even as I navigate these challenges, I remain dedicated to building moments that matter.

I also continue to invest fixed amounts weekly and monthly. If that ever changes, you’ll know a powerful shot sent us to the canvas.

But we’ll always rise, and we’ll keep swinging.

This is a 12-round fight, and we’re prepared to go the distance, embracing both the struggles and the victories along the way.

Surviving a legal storm

Legendary boxer Mike Tyson once said, “Everybody has a plan until they get punched in the face.”

Give, and it will be given to you

I’m suddenly questioning my gift-giving abilities, and I can’t help but blame my daughter Parker.

Hang in there Champ!!