Legendary boxer Mike Tyson once said, “Everybody has a plan until they get punched in the face.”

He was talking about the unpredictability of boxing, but his famous line also resonates with my budget.

Just when I thought I had formulated a solid spending plan for 2025, unexpected legal fees hit me like a surprise left hook. My financial picture now has more plot twists than a soap opera, leaving me dodging drama like a well-trained prizefighter.

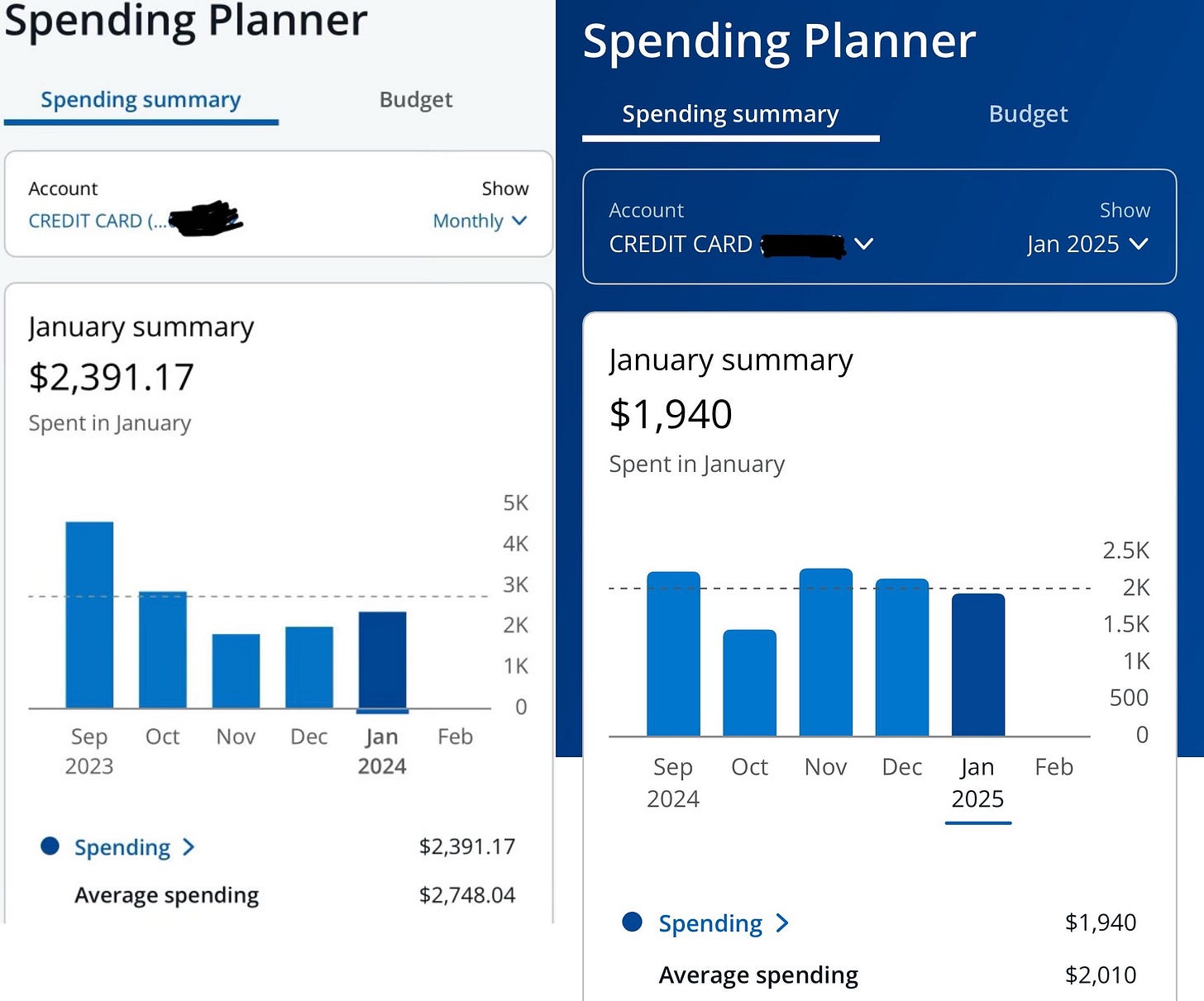

After sharing eight financial goals for the New Year, I settled on a sensible ninth: keeping my credit card spending below $25,000. While reducing my spending further isn’t essential to my goals, I’m pushing myself to develop greater discipline in living below my means. To achieve this, I must spend less than $2,083.33 per month, which feels doable.

But before the calendar flipped deep into the second week of January, a circuit judge ordered me to pay more than twice that amount in legal fees. Inside the courtroom, where I appeared to fight for my rights in the face of continued wrangling with my co-parent, I caught a devastating counterpunch. Just like that, the judge’s ruling put me more than two months behind.

When I walked out of the courthouse, still with 51 long weeks ahead of me, I had no choice but to reassess my budget. I’m now obligated to pay, and if I don’t by a certain date, I could face much bigger problems than just my annual budget.

By tracking my monthly and yearly spending, I can easily identify areas where I can cut back.

I make the majority of my purchases with a credit card so I can accrue airline points to fly for free. A few mainstays are excluded, such as rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership. However, with the lion’s share of my expenses going on my credit card, it’s the best way to monitor my monthly spending, and each month I share my progress, for better or worse.

My statement shows I spent $1,940 last month, about $450 less than January 2024.

Legal fees accounted for a staggering 45% of that total. I made the first of what will be several payments on Jan. 30, an $864.50 charge. My February statement will show a larger amount. I must pick up the pace on paying the debt.

But I’ve come too far to let a setback break me.

I’ll shift my behaviors and sacrifice simple pleasures. I’ll adapt and survive.

To cover the fees, I’m forced to draw on earnings from side hustles. The good news is I have the money to cover the debt. The bad news is 100% of those funds are earmarked for investments. I despise dipping into that pool of money for anything other than assets. I do everything possible to never interrupt the compound effect.

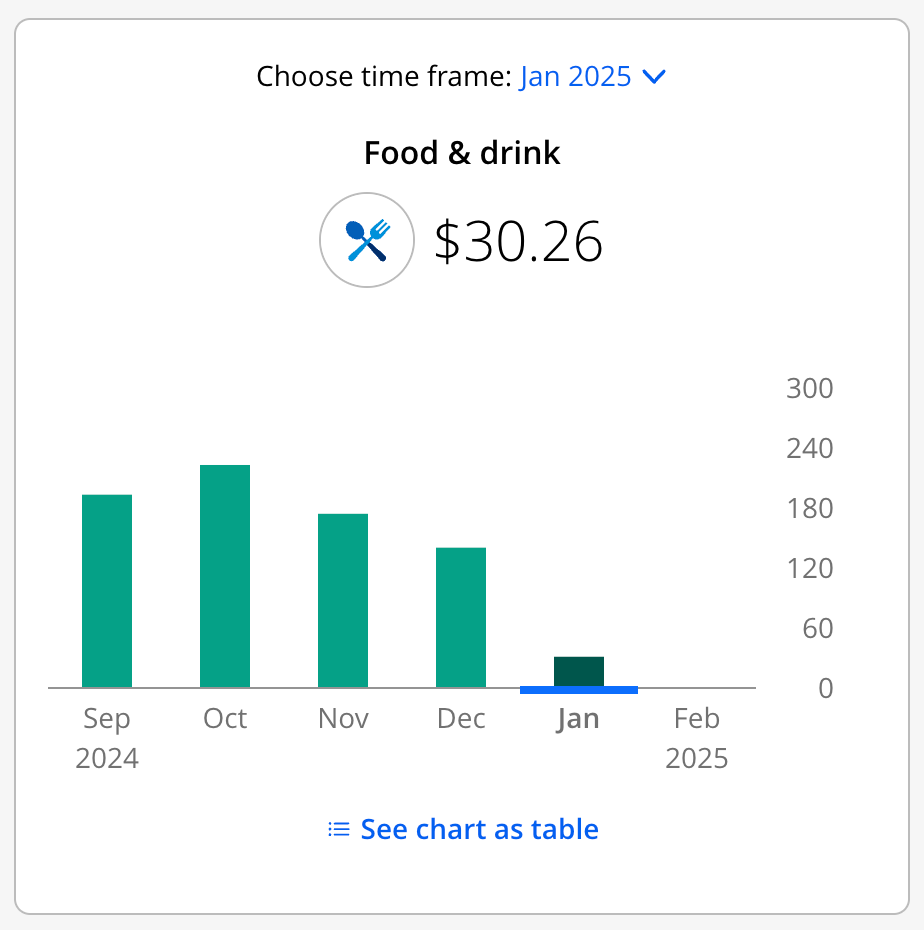

And so I scaled back significantly last month.

I didn’t dine out at all in January, which I’m extremely proud to report.

The food and drink category on my credit card statement shows only two charges for the month. The first is a $9.40 fee for Panda Express — for my daughter Parker.

On Jan. 7, I happily bought her an orange chicken bowl for “Lunch with my Learner” at her school. The quality time spent and cherished memories we made were worth the lone blemish. Parker even pointed out her first crush to me!

A $20.86 liquor purchase from Binny’s Beverage Depot was my other food and drink charge in January.

And it made me sick — literally.

I drank too much. The next morning, I felt like I’d been hit by a thousand left hooks. Head shots. Body blows. Combos. The works. The agony returned in a different form while reviewing for this column. That’s when I did the math.

If I made only one liquor store trip each month, and I paid just $20.86 on each visit, I would spend $250.32 this year on alcohol. Even that is more than I care for.

It might not sound like much, but it’s a slippery slope. Remember, I’ve been down that road. My alcohol tally in December, for example, was $121.82 — which would equate to $1,461.84 a year. I’m better off in every way drinking water.

Naturally, because I didn’t eat outside my home, groceries, bills and utilities accounted for another 42% of my January spending, or $810.52.

That means that only 13% or less of purchases last month weren’t out of necessity.

It wasn’t my plan coming into the New Year.

Neither was getting punched in the face.

Give, and it will be given to you

I’m suddenly questioning my gift-giving abilities, and I can’t help but blame my daughter Parker.

A quick escape, a lasting financial shift

Do you remember that magical trip to Minneapolis I told you about last month?