The most valuable financial weapon in my arsenal comes from my primary credit card — the spending planner.

This unassuming tool has transformed the way I manage money, providing clarity and control over my finances.

I wish I could tell you it’s free, but technically, it’s not. My credit card company charges an annual fee of $149. However, the perks make it worth it.

With my rewards credit card, I accrue airline points that allow me to fly for free. This has long been my primary focus and is why I use my credit card for most of my purchases. As long as I pay the balance in full each month to avoid interest fees, I can enjoy even more benefits.

After the airline points, the next biggest advantage for me is the built-in tracking tool. I love it because it eliminates the legwork and makes budgeting a breeze.

The data I collect is the same that I share with you when reviewing my spending each month. I don’t require another app or some expensive service.

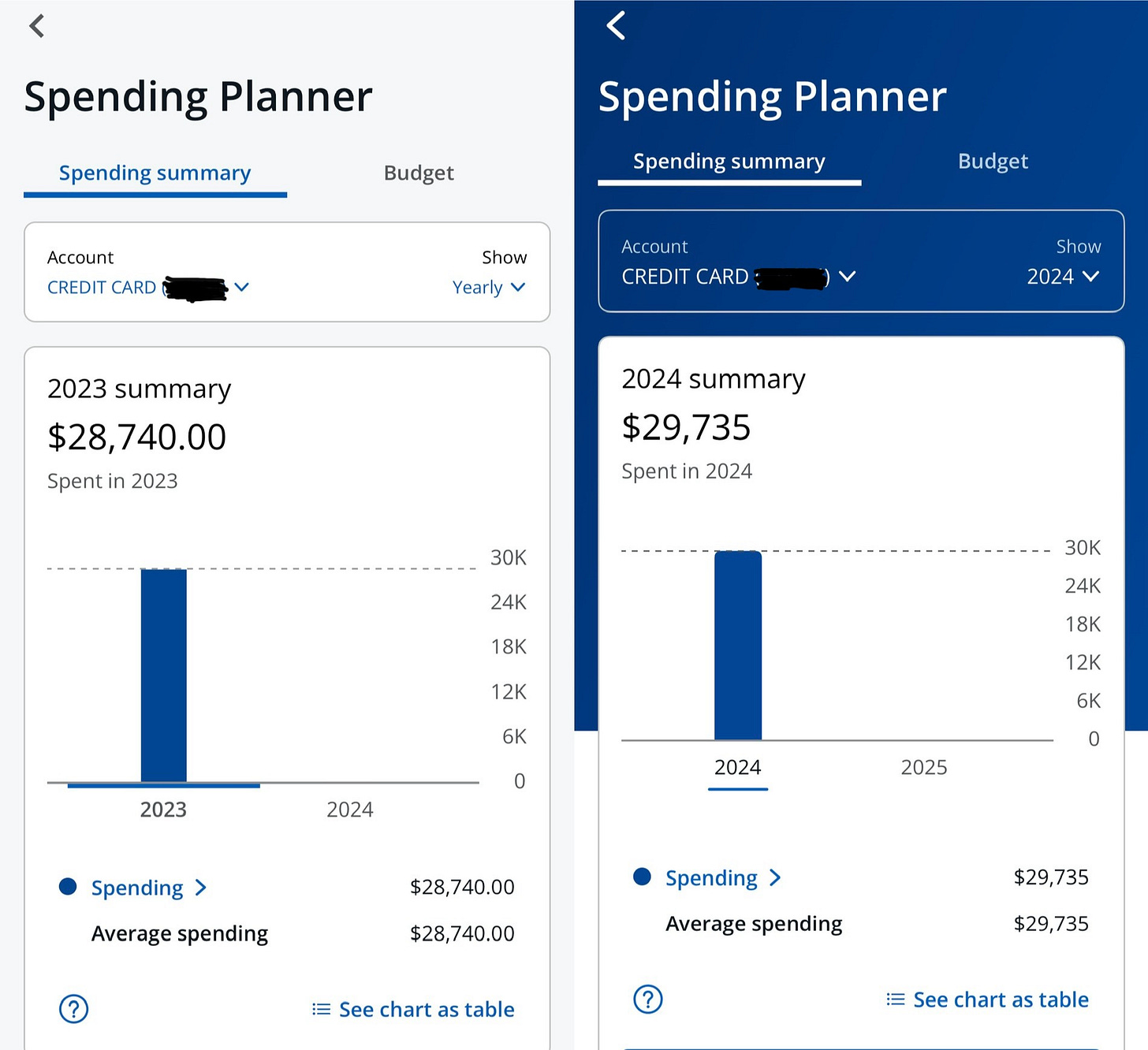

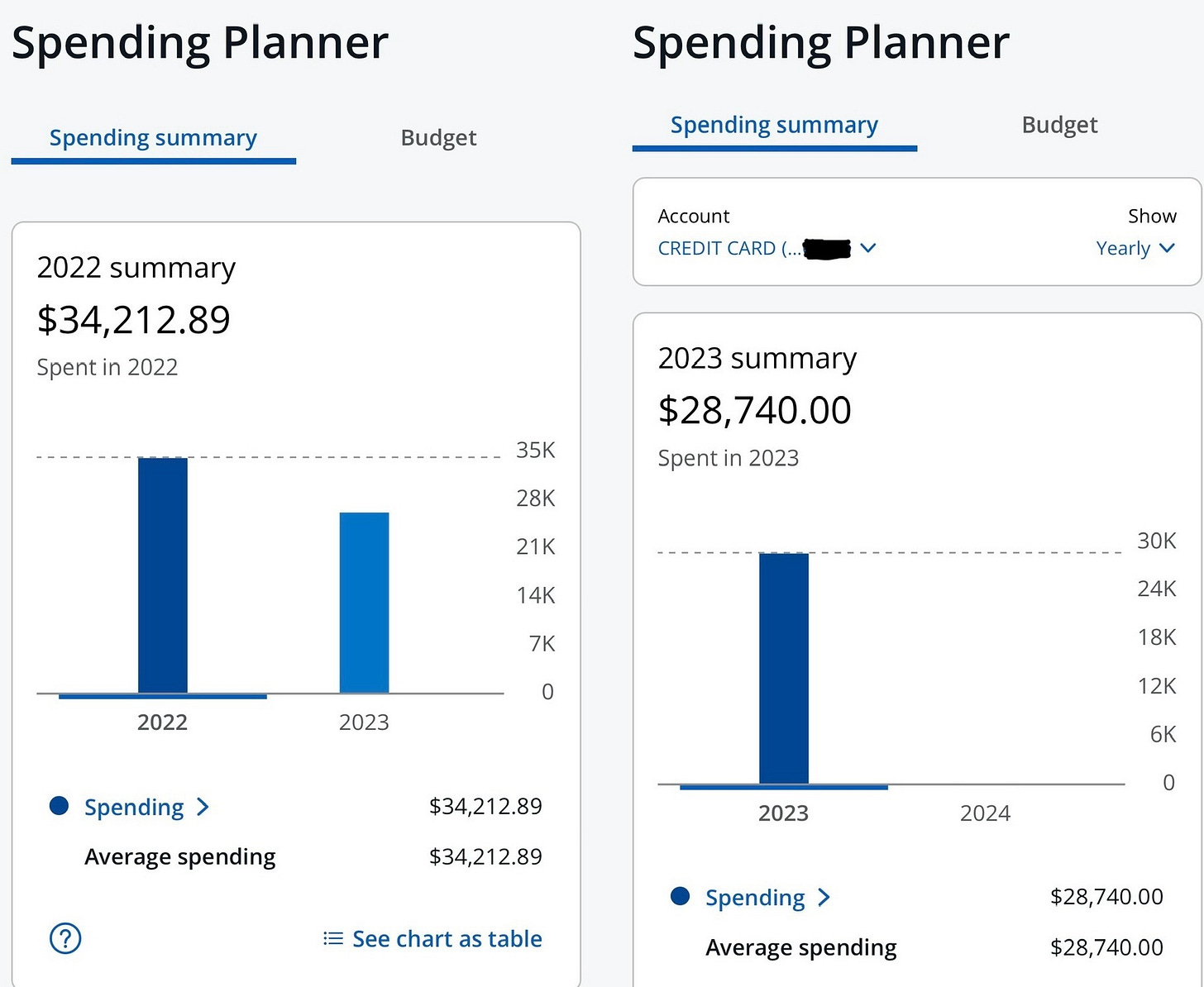

For example, I learned from the spending planner that I charged only $995 more in 2024 than I did in 2023. My consistency with my spending was noticeable in several months last year. Thanks to tracking, I’m reducing my spending and building year-over-year stability.

The same spending planner showed I spent $34,212.89 in 2022.

The worst part? I couldn’t tell you with certainty how I blew through an extra $5,000. I didn’t start diligently tracking my spending until August 2022. My guess is I threw money down the drain on familiar old vices: pizza and beer, subscriptions and sports, dating and dining out.

Since I started tracking consistently, I’ve identified five key areas where I’ve gained more control over my money.

Awareness. Tracking your spending instantly reveals where your money is going and helps identify unnecessary expenses. This alone could save you hundreds or even thousands of dollars.

Better budgeting. Seeing where your money goes helps you live below your means. Sometimes, it’s as simple as facing the problem head-on.

Categorized purchases. One of my favorite features. I get an itemized breakdown of exactly how much I spend on assets versus liabilities, making it easy to understand my spending habits.

Improved savings. Highlighting areas where I can cut back is critical. Once I identify them, I can address the issues and save more.

Accountability. I can never say I didn’t know. More importantly, tracking my spending has promoted healthier behaviors while reducing my anxiety around finances.

By comparing details from my annual spending report — physical copies I’ve had mailed to me over the past two years — I see my strengths and shortcomings.

I paid $4,600 less for auto services in 2024 than in 2023. Buying a new car in 2023 wasn’t a bad idea.

However, any savings on my vehicle were virtually negated by increased charges for professional services (+$2,600) and groceries (+$900). I don’t mind the rising grocery bill; it’s a good sign that I’m eating at home.

But my consistency popped in the entertainment category. The difference? Just $11 less in 2024.

We’ll see what 2025 brings.

I’ve set a bold new financial goal: to keep my yearly spending below $25,000. That breaks down to a manageable $2,083 per month.

With my spending planner, I’m ready to track my progress and make it happen.

It sounds like a great tool to have. And your spending is under control. Well done :)