A sigh of relief washed over me as the first quarter of the year came to its merciful end.

After navigating the chaos of rising costs and relentless pressures, I’ve found solace in knowing I’ve persevered. Overcoming unforeseen financial challenges has fortified my mental resilience, proving that I can withstand difficulties and emerge even stronger.

Yet, the hardship rocked me to my core just when I thought I was on the right track, diligently following the path I had meticulously mapped out. The turmoil shattered my sense of stability, threatening my foundation and the solid financial footing I had worked so hard to build.

At times throughout the first three months, my circumstances left me questioning everything I once believed to be secure.

But now, I look forward to Q2 with a renewed sense of hope and possibility.

I must be more determined than ever to stick to the goals I’ve set, trusting that my persistence is key to achieving the success I envision.

Now that the financial struggle is over, I could easily fall into old habits, and a part of me feels tempted to do so. Thoughts of deserving a reward swirl in my mind, urging me to consider scaling back on my investments. Tapping into some cash feels both timely and instinctive. After three months of mostly paying off debt, I can’t help but feel it’s finally time to treat myself.

But that would be a shortsighted decision. Giving into temptation could undermine all the progress I’ve made, and lasting success requires patience and discipline.

That’s why my diligence must endure. I’ll find ways to build in small rewards.

For now, I’m choosing to stay committed to my long-term goals, understanding that with each small sacrifice today, I’m investing in a more secure tomorrow.

Rather than spend recklessly now that I have more breathing room, I plan to maximize my flexibility by focusing on the future. I will achieve this by planning ahead and mapping out the next three months — something I’ve never done before.

If I were a company, I’d be rolling out my guidance — complete with a flashy PowerPoint and plenty of snacks!

This marks a new level in managing my finances — transitioning from a reactive approach to a proactive one, shifting from a month-to-month mindset to planning quarter by quarter and, soon, year to year.

Armed with this new strategy, I can look ahead with confidence, even in light of the damage that’s been done.

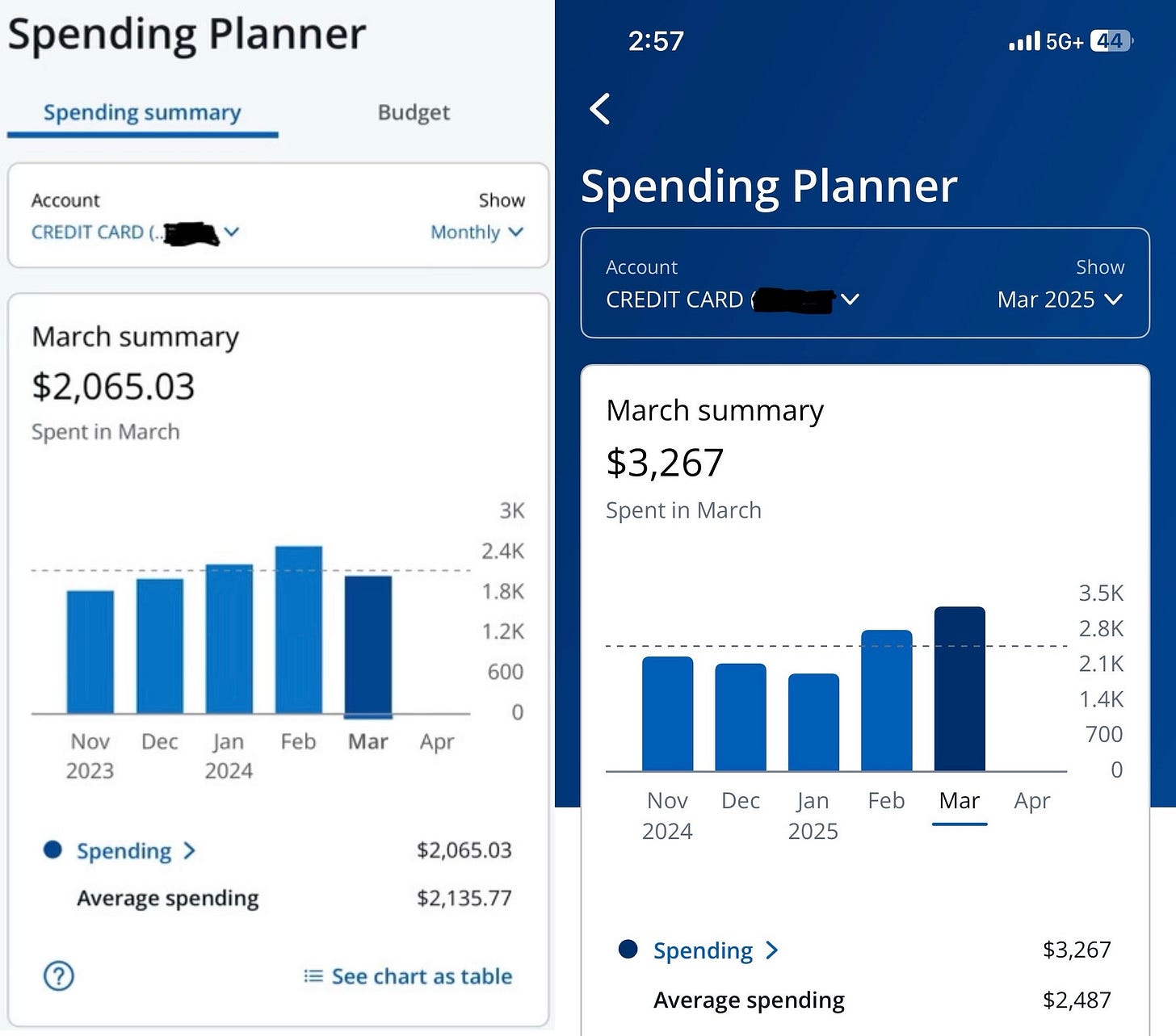

In Q1, my credit card statements show that I paid $2,752 in legal fees, culminating with a final payment of $352 on March 26.

I make the majority of my purchases with a credit card so I can accrue airline points to fly for free. A few mainstays are excluded, such as rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership. With most of my expenses on my credit card, it serves as the best tool for monitoring my spending, and each month I share my progress, for better and worse.

Unlike the first two months of the year, March saw a spike in work travel expenses, totaling $1,675 across four cities in eight days. As long as I remember to file the necessary paperwork, I’ll be reimbursed.

But on paper, this transformed my March spending into an eyesore, totaling $3,267, my highest balance since May 2024, when legal fees also inflated my bill.

However, after subtracting last month’s work trips, I’ve charged $6,337 in personal spending over the first three months, averaging $2,112.33.

My goal is to limit my credit card spending to $25,000 this year, which means I need to keep my monthly spending under $2,083.33.

Given all that Q1 threw at me, I’m proud to be just $29 off pace. I’m confident I can get back on track and regain my momentum.

That said, I anticipate additional uncontrollable expenses in Q2, underscoring the importance of my quarter-to-quarter planning to navigate these challenges effectively.

I have lingering car repairs that need to be addressed, which could add to my financial strain. Plus, there’s a special birthday in May and our annual Oklahoma vacation in June. On top of that, we just kicked off Q2 with our first Daddy-daughter trip to Disney World on April 1, which I’ll share more about next week.

I’m also anticipating an increase in my child support obligation, which is a whole other concern.

With all these expenses looming, staying disciplined and sticking to my budget will be crucial in the coming months. But I’m feeling optimistic about navigating these challenges.

By being strategic with my spending, I can cover my obligations while still making progress toward my financial goals.

And I’m excited about the experiences and memories ahead!

Round 2: My financial fight rages on

The financial blow I’d been bracing for landed hard on the third day of February, a brutal left hook I couldn’t dodge.

Surviving a legal storm

Legendary boxer Mike Tyson once said, “Everybody has a plan until they get punched in the face.”

Give, and it will be given to you

I’m suddenly questioning my gift-giving abilities, and I can’t help but blame my daughter Parker.

When I read your Thursday morning column and listened to doom and gloom and insensitive Bravado, I wanted to say “Houston, We have SOME PROBLEMS!!”

It’s not fear that I have for the second quarter of 2025, it the reality that the next three quarters of 2025 could be devastating beyond my ability to save/ limit spending/ invest prudently and rewardingly, so that I/We survive the

next three years, not to mention years beyond this day.

Only over by $29 is amazing! Can’t wait to see what you do in this next quarter!